One of the primary underlying tenets of Project Production Management (PPM) is that operators can and should be calculating the appropriate level of inventory required within and between each task in their project. While almost all operators track inventory, or WIP, few to none know what that inventory should be. In addition, there is a lack of clarity around the financial impacts of controlling inventory and how this relates to equity performance. This article aims to explain the three main areas of financial impact once PPM is implemented. These are: 1) a reduction in cash tied-up / working capital, 2) a reduction in capex to deliver the same number of wells, and 3) an increase in project net present value. These impacts, in turn, will lead to higher free cash flow and stronger return on cash invested – two very important financial metrics used to judge the health of the US oil and gas industry. While PPM can be applied to any capital project, this article will focus on onshore unconventional developments.

Keywords: WIP; Throughput; Variability; Little’s Law; Financial Implications

Positive free cash flow and return on cash invested are two very important financial metrics used to judge the health of the US oil and gas industry. Money available today is worth more than the same sum in the future due to its potential earning capacity. The quicker you can finish a project and get the cash register ringing, the more your project is worth today.

Most operators do not control their inventory, causing excess cash to be needlessly tied up in the production system. This is true whether the production system is the development of a large offshore field, an LNG liquefaction train or an onshore unconventional development.

One of the primary underlying tenets of PPM is that operators can and should be calculating the appropriate level of inventory, required within and between each task in their project. Almost all operators track WIP but few to none know what that inventory should be.

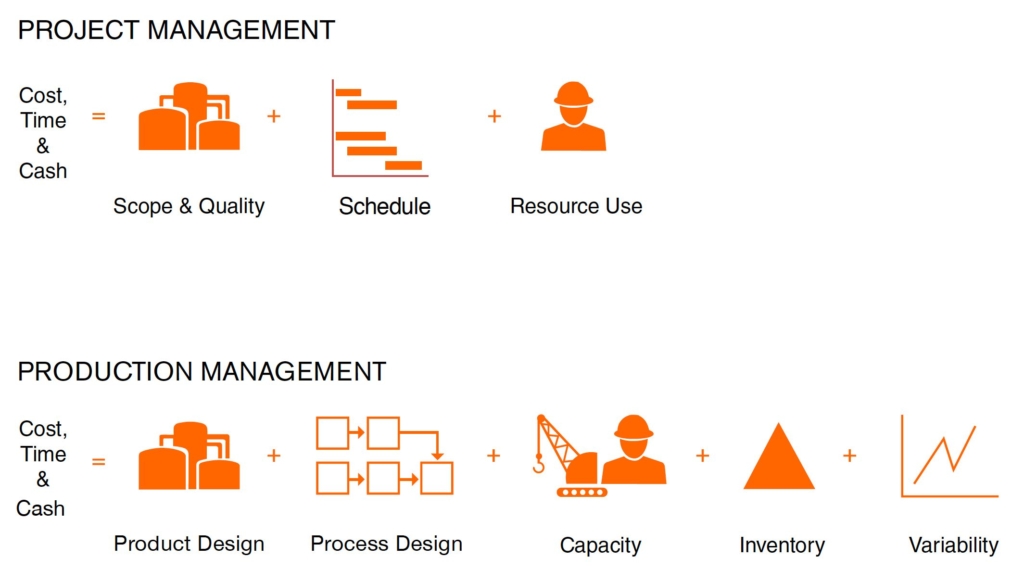

In addition, there is a lack of clarity around the financial impacts of controlling inventory and how this relates to equity performance. To clarify this, we must first understand that PPM diverges from conventional project management in two important ways. First, it highlights the importance of calculating and controlling WIP (inventory). And second, it emphasizes reducing variability in the system (see Figure 1). The financial impact can then be assessed in terms of lower inventories, reduced waste and faster cycle times.

Once PPM is implemented, the three main areas of financial impact for onshore oil and gas companies are as follows:

These impacts, in turn, will lead to higher free cash flow and stronger return on cash invested – two very important financial metrics used to judge the health of the US oil and gas industry. For further discussion on how to calculate and understand WIP, see Spearman and Choo’s “Unintended Consequences of Using Work-In-Process to Increase Throughput” (Spearman & Choo, Unintended Consequences of Using Work-In-Process to Increase Throughput, 2018).

Figure 1: Project management compared to project production management (Shenoy & Zabelle, 2016)

As most operators do not control their inventory, excess cash ends up needlessly tied up in the production system. This is true whether the production system is the development of a large offshore field, an LNG liquefaction train or an onshore unconventional development. How much cash an operator ties up depends on how much control they have over their production system.

PPM reduces cash tied up in two important ways: 1) by calculating daily the amount of inventory the system needs to optimally run so you never have too much or not enough; and as a consequence 2) by compressing the cycle time of the project, resulting in the freeing-up of resources sooner. Because people are now only doing the work that is needed, when it is needed, another benefit of PPM is to have significantly fewer re-works of well designs, engineering, etc.

In our work with onshore unconventional producers, we have seen reductions in cash tied up of 50%-70% over the course of a one-year drilling program from implementing PPM. We often encounter companies that have taken actions that end up worsening their situation due to lack of understanding of PPM. For example, increasing batch sizes (number of wells on a pad) will increase cycle time which will tie up more cash; this should only be undertaken if the geological trade-off is proven to be worth it.

Another valuable benefit of PPM is an overall reduction in capital expenditures for a project (in this case, the capital project is defined as an unconventional onshore development). This reduction in capex is a direct result of knowing exactly how much WIP/inventory you should have and where in the system it should be. The savings come because the operator is no longer carrying unnecessary WIP.

We often think of WIP in the form of equipment (rigs, frac crews, pad construction, etc.) and supplies (OCTG, drilling mud, etc.). But another important cost center is knowledge work like completion design, permitting, management, etc. Looking at an operator’s G&A per barrel of daily oil equivalent production tells us a lot about the cost of this work on the bottom line.

Once PPM is implemented, the amount of capital needed to produce the same work is lower. An onshore unconventional operator can now “produce” (drill and bring online) the same number of wells for less capital or it can produce more wells for the same capital – that is the operator’s choice.

Operators can also decide in real time where to shift capital to maximize throughput. This provides a level of agility that most operators currently do not have. Take the recent trend of “frac holidays.” This is a clear signal that the operator isn’t using PPM. It is likely that the operator ran out of capital and therefore stopped completing wells (but kept on drilling new holes). Because staying within capex guidance was rewarded by the market over production growth, operators got away with it.

Under PPM there are no “frac holidays” unless the operator purposely dials it in which few would do as this provides little value to shareholders. Instead, the operator sets the throughput and calculates the cycle time and resulting WIP (Hopp & Spearman, Factory Physics (Third Edition), 2011, p. 239). The system updates daily based on what actually gets done and is constantly solving to reach the stated throughput and associated spend. This enables operators to have tight control over their capex which helps in setting and meeting guidance to the Street. If the operator wants to change guidance, it is their choice rather than the result of having no control over their production system.

In our work with onshore unconventional producers, we have seen reductions in capex of 10%-40% over the course of a one-year drilling program from implementing PPM. This may seem small. But considering the industry plans to spend around $152 billion (Oil and Gas Journal, 2019) on upstream developments in 2019, this translates into savings of $15-$45 billion, not exactly chump change.

The reduction in cycle time that results from implementation of PPM means the operator’s project comes onstream faster. For anyone who has taken an economics course, you will recognize this concept as “time value of money.” Others will recognize this concept via Ben Franklin’s advice: time is money. Basically, today’s dollar becomes weaker over time. Or put another way, money available today is worth more than the same sum in the future due to its potential earning capacity (Damodaran, 1996). The quicker you can finish a project and get the cash register ringing, the more your project is worth today.

Also, remember that PPM has reduced capex and inventories so the capital going into the front end of your project is also lower, which will result in a higher net present value. Excess WIP has a devastating impact on project NPV in that it adds additional costs while providing essentially no value, thus decreasing overall profitability. And who cares the most about profitability? The C-suite and shareholders.

And, as if all of this weren’t enough to convince operators of the merits of PPM, one final area of impact is the increased ability to push new technology into and through the system. Because the entire system is optimizing every day, pushing new technology in is much faster and easier than under conventional project management.

In our work with onshore unconventional producers, we have seen improvements in project NPV of greater than 100% over the course of a one-year drilling program from implementing PPM. The reason this is so high is because of the impact on NPV of shorter cycle times. Analysis by Stratas Advisors found that for a 200 well program over the course of one year, removing just one week of “down time” resulted in a $35 MM improvement in NPV. Considering that many operators could stand to remove at least 6-8 weeks, this becomes a very large number.

There is a further impact to freeing up cash, reducing capex and increasing NPV and that is the impact on free cash flow (FCF). Assuming we define free cash flow as cash flow from operations less capex less dividends, then reducing capex and working capital changes will improve FCF. Improving NPV will show up as higher cash flow from operations. Net Income would also be impacted due to lower DD&A over time. And from here it is easy to see how return on capital employed will improve – by increasing the numerator and decreasing the denominator.

Positive free cash flow and return on cash invested are two very important financial metrics used to judge the health of the US oil and gas industry. Therefore, we can now tie PPM directly to improved shareholder returns by its ability to improve FCF and any return metrics associated with it.

Implementing Project Production Management (PPM) has a clear and measurable positive impact on the financial performance of oil and gas companies. It impacts three areas: cash tied-up / working capital, capex, and project net present value. This, in turn, should influence the operator’s share price performance and hence improve their shareholder returns.

The most obvious question to ask is: why aren’t all operators rushing to implement PPM?