Industrialized construction (IC) means many things to many people. It is a concept that has been rediscovered time and again. In recent years, interest in IC has been sparked anew thanks to the promise of increasingly affordable automation, readily available cloud computing, and AI driving innovation in our industry. While jumping on the bandwagon now may be more tempting than ever, individual companies—producers or investors—will want to articulate their rationale for moving towards IC. This rationale will determine what investments are suitable for their circumstances. To illustrate, this paper describes three companies that invested in IC, pursuing a variety of rationales and achieving different levels of success. Acquiring hardware tends to be the easy part. It must be warranted by the company’s production system design(s) founded on operations science principles, and accompanied by people’s know-how and ways of working (company culture and processes). A takeaway from the literature and interviews conducted for this paper is that production system design and operations science are seldom mentioned, yet these are crucially important for company success especially when counting on IC to improve production system performance.

Keywords: Industrialized Construction (IC); Automation; Robotics; Lean Construction; Production System Design; Operations Science.

Rafael V. Coelho is an Engineering and Project Management PhD candidate in the Civil and Environmental Engineering department at the University of California, Berkeley. He is a Researcher affiliated with the Project Production Systems Laboratory (P2SL – p2sl.berkeley.edu) at UC Berkeley. His research focuses on integrating Lean Production princi ...

Iris D. Tommelein is a Professor of Engineering and Project Management in the Civil and Environmental Engineering Department and directs the Project Production Systems Laboratory (P2SL) at the University of California, Berkeley. She has been studying, developing, and applying principles and methods of project-based production management for the arch ...

Industrialized Construction (IC) is defined as “the application and use of high-volume manufacturing methods and technologies to the delivery of capital projects, including the use of product development, flow-based production processes and automation” [1]. IC applications can be grounded in the principles of operations science [2], [3] and broadly speaking include practices such as articulating the business case and defining customer value, designing for manufacturing and assembly (DfMA) (e.g., [4]) or more generally designing for excellence (DfX), devising and deploying the most-suitable tools, equipment, automation opportunities, and robotics, integrating data and control systems, etc. The IC mindset applies not only to manufacturing in a narrow sense (i.e., physical or virtual work done within the walls of a single facility or the realm of a single organization) but also to the value stream at large. Successful implementation of IC will be holistic and comprehensive, involving owners, designers, suppliers, fabricators, service providers, builders, capital project users, operators, and other stakeholders or beneficiaries.

In the value stream of capital project delivery, the term IC tends to evoke thoughts around ‘offsite vs. onsite,’ ‘modularization,’ ‘Modern Methods of Construction (MMC)’ [5], and ‘automation’ of construction. Indeed, tremendous possibilities are offered beyond mechanization (using the right tools for the job) through the use of automation and cloud computing (programmable tools and equipment, such as CNC plasma cutters driven by CAD software) and robotics (automation based on structured data plus so-called cognitive automation using equipment augmented by some form of Artificial Intelligence (AI)). These can help to address industry-wide challenges pertaining to labor shortages, diminishing productivity, low efficiency in execution, inferior safety performance, and questionable quality. However, success is neither automatic nor guaranteed.

For example, an IC implementation can be too local for the benefits thereof to be significant or extant at all at the production system level, and deteriorating system performance is a possible outcome as well. A local implementation will require mutual adjustments with other parts of the system because of structural- and more complex interdependencies. Given that many IC implementations are local (e.g., the deployment of a new robot in an existing production system), studies that apply methods of Project Production Management (PPM) [6], [7] will help ascertain that the newly-shaped production system will exhibit the desired functionality when put in operation. Such PPM studies—of a local implementation in an existing system, or of an entirely new system—will involve analytical modeling (e.g., [8], [9]) and discrete-event simulation of the system viewed broadly (e.g., [10], [11]). Subsequently, real-time monitoring and control will help keep the system tuned to changes in the needs it is to fulfill.

The section that follows lists a variety of rationales that may drive the desire of a company to invest in IC. The three sections thereafter each describe a company that invested in IC while pursuing a certain rationale and approach that achieved (or did not achieve) the anticipated level of success. In the process of searching for literature about these companies’ practices and conducting interviews to further substantiate this paper, the authors paid attention specifically to any mention of ‘production system design’ and ‘operations science.’ The conclusions section expands on the findings and lessons learned.

Companies engaged in the construction industry at large will want to articulate their rationale for adopting IC. Their reasons could be manifold, such as the need to address urgent challenges the company is facing or the desire to gain new capabilities to ensure competitiveness in the future.

IC investments can help companies address challenges they are facing in the marketplace. Examples are that (1) the company’s production throughput is unsatisfactory, e.g., due to quality issues causing many rejects or rework and thus a low yield, or (2) their throughput needs to increase in order to meet the demand for the produced products or services. (3) The company needs to scale up to become profitable (e.g., gain efficiency and achieve lower unit cost). The company may (4) seek improvement by integrating automation into their existing systems and overcome legacy system limitations (e.g., inefficient materials handling, low energy efficiency, excessive scrap), or (5) have the need to physically expand their facilities. Last, but not least, the company may have concerns about (6) worker safety and ergonomics, and (7) labor shortages, and is looking for tools and equipment that make the job more appealing.

In contrast, IC investments are made by companies, perhaps not because they face immediate challenges, but rather because they are on the outlook for what the future may bring. Examples are that (1) company employees heard of benefits touted by IC advocates (e.g., the ‘promise’ of AI) and seek the means to capture data more systematically to allow for better (machine) learning. (2) They wish to gain new capabilities to become more successful in the marketplace. (3) Whether or not they are operating at the edge of innovation, they need to keep up with the competition. (4) They are just curious and want to stay informed of technological advances. Any or all of these may result in investments in IC for consideration and testing.

Clearly, IC investments are driven by many rationales. A rough characterization [12] may be that 50% of the time a rationale may be governed by sales-based decisions to gain or maintain competitive market share, 25% of the time by a return on investment (ROI) calculation, and 25% of the time by a ‘gutfeel ROI.’

IC implementation typically requires the acquisition of several components. Acquiring hardware may be the easier part nowadays (especially given 3D printing technologies that can print robotic arms or so many other things). The harder part is that hardware requires software (locally managed or software as a service (SAAS)) as well as worker knowledge and skills to operate and maintain both. Any new acquisition of hardware or software needs to be duly integrated into the operating system of the company and made suitable for the specifics of the context in which it is deployed. If this is not done, IC adopters will find themselves in the situation described as the Solow Paradox [13] [14], a term coined in the 1980s when the implementation of computers in the workplace did not result in the anticipated productivity improvements.

Paul Akers [15] provocatively states that any new machine is as bad (sic) as it ever will be, as the company that acquired it will immediately start their process of continuous improvement to best support its Lean operations. That is, a company will need to gain IC know-how and establish new ways of working (processes and company culture), requiring (re)training of in-house personnel or outsourcing of support & upgrades. At the same time, IC will likely change the needs and capabilities of a company, and this may necessitate the development of new value stream relationships and partnerships.

The following sections present companies that invested in IC to various degrees, pursuing quite different rationales and achieving different levels of success.

Katerra was founded in 2015 by professionals, successful in the manufacturing industry and real estate development, who had set their ambition on disrupting the construction industry [16]. Their vision was to position the company as a fully integrated service provider ready to tackle the highly fragmented and due-for-reform Architecture Engineering Construction (AEC) industry, an industry that has failed to consolidate [17]. The company went bankrupt in 2021 [18]. A lot has been written about Katerra’s spectacular rise and downfall and, yes, the Covid-19 pandemic played a role, but there were many other reasons for their failure (e.g., [19], [20], [21], [22]).

Among these reasons was Katerra leadership’s inability to fully recognize and harness the numerous sources of uncertainty (e.g., demand for their products and services), variability, and waste (e.g., challenges with tolerance management [19] and delays due to iteration and time-consuming handoffs) that plague the industry at large. Rather than focus on specific project production systems, grasp their complexity, and then properly structure-, fine-tune-, and operate them, Katerra leaders exposed their company to huge amounts of uncertainty and variability by entering—in a very short amount of time—into multiple sectors of the construction industry (including multi-family housing, hospitality, and schools), and taking on projects in countries across the globe (including projects in Saudi Arabia [23] and India [24]).

Balancing supply with demand is no easy task. To fill their demand pipeline, Katerra convinced prior- and new partners in their network of owners and developers, to order from them. On the supply side, Katerra simultaneously pursued both vertical- and horizontal integration to form a consolidated ecosystem. Vertical integration was pursued through acquisitions of existing architectural- and contracting firms. However, getting everyone to integrate and act as one was a different matter. Horizontal integration was pursued by setting up their own factories in Arizona, California, and Oregon, and the company had plans to further establish one in San Marcos, Texas. As advertised [25], Katerra’s “unique ‘Integrated Factory’ model connects Katerra factories directly to our job sites, ensuring a seamless transition from manufacturing, through delivery and installation. This approach extends the speed, precision, coordination, and quality assurance of our factory environments directly to Katerra job sites.” This too was more easily said than done. Katerra’s ambitions failed in execution [26]. A reason is that full automation may result in efficiency and cost effectiveness of product production, but marketplace demand for these products must be sufficiently high or factory investments will not yield a satisfactory ROI or profit.

In 2017, Katerra opened a 250,000 ft2 semi-automated factory including a design showroom in Phoenix, Arizona, to produce interior- and exterior wall panels, roof truss assemblies, floor systems, utility walls, cabinetry and countertops. It closed this factory down in 2019 [27] to shift production to Tracy, California, where Katerra had built a 577,000 ft2 fully-automated, autonomous prefabrication factory with 30 fixed robots, 12 mobile robots, and a digital manufacturing process using self-guided vehicle technology to produce wood-frame wall assemblies, floors, cabinets and finishes, roof trusses, windows and light-gauge steel structures [28], [29]. Katerra also built a 250,000 ft2 mass timber factory in Spokane, Washington to produce 4.6 million ft3 of cross-laminated timber annually [30].

Furthermore, Katerra’s ambition to disrupt the construction industry included innovating through research (e.g., setting up testing facilities, productizing modular components, and applying for patents) and strategically using automation and robotics. With $865 million of ‘disruptive’ funding provided by SoftBank Group Corp.’s Vision Fund in 2019, money was no issue. Katerra overinvested and overextended itself, or, simply put: they bought too many robots. An indication of the latter is that, following Katerra’s bankruptcy, VBC bought their Tracy facility for $21.25 million in August 2021 [31]. VBC seized the opportunity to establish manufacturing capabilities on the east coast of the US for their business in multifamily high-density modular construction. In the process of making the facility operational for their business case, they sold many of the robots and freed up space [32].

Summarizing in a few words what happened to Katerra: all the uncertainty and variability blew up on them. They did not have an execution focus. Arguably, Katerra leadership was not concerned with project production system design, and they did not adopt an operations science perspective as these would have enabled them to see, among other things, how detrimental the impact of variability is on production system performance.

If Katerra’s experiment at disrupting the construction industry was successful, in a way, it is because many lessons could be and have been learned from this short-lived venture, and it makes for a stunning case study.

The second case described in this paper has an entirely different focus, namely on the use of IC in a fabrication shop.

The second case pertains to Walters & Wolf [33], a vertically integrated architectural company that designs, engineers, fabricates, and installs exterior cladding systems such as curtain walls. The company was established nearly 50 years ago and has weathered industry changes by actively investing in its people and relentlessly innovating (e.g., [34]). To cater to regional demand for their services and be closer to their construction sites for installation, they opened offices and fabrication shops in several parts of the US.

The company’s fabrication shops are designed and operated using Lean manufacturing principles, methods, and practices [35], [36]. The materials supply- and staging areas, cutting equipment, hoists for handling large glazing panels, tools to apply weatherstripping and sealants, etc. are laid out so that assemblies flow according to the requisite takt from one station to another. Company employees are collaboration partners on projects that use Integrated Project Delivery (or other) commercial terms. They are technology-savvy expert users of Virtual Design and Construction (VDC) systems, including developing and exchanging Building Information Models (BIM) with trade partners and transferring digital data to and from their shop.

The shop floor is equipped with electric hoists, highly automated and lower-tech machines, as well as tables on wheels, staging racks, etc. to provide well thought-out functionality of their worker-paced line flow. This notwithstanding, the company ran into a challenge after investing in a new piece of IC equipment, “a new shiny thing” [37].

Due to changes in the company’s product portfolio and enticed by new machine capabilities offered in the marketplace, the company decided to invest in a sophisticated 16-axis cutting machine. This machine could perform the work done at three stations in the current workflow, and complete that work with greater precision and much faster. Of note, though, is that a machine’s speed quoted by the manufacturer describes capabilities when operating under optimal conditions. This speed will inform the calculation of (daily) throughput, but the calculation must also account for other production system design variables. As for any ROI calculation of an investment of this kind, the immediate impacts of the introduction of IC automation on the company’s production system and business overall should be taken into account, as well as the longer-term impacts.

As far as immediate impacts are concerned, consider that a workday will include planned- and unplanned downtime. Walters & Wolf experienced significant unplanned downtimes of their new equipment because sensitive sensors stopped functioning when obstructed by small metal cutting chips. This variability resulted in the unit shutting down randomly and then requiring trouble shooting as well as technical expertise to get it to restart. Consequently, the shop staff observed that the uptime of the new unit is roughly only about 40-50%. In contrast, the uptime at more manual stations (i.e., using less complex machines and operated by people) is 90% if not more, as people are flexible in dealing with a wide range of situations at their station and can adjust rapidly [37].

Furthermore, the speed of the machine (when operational) relative to the speed of the remainder of the worker-paced line created an imbalance in the previously leveled workflow. This speed imbalance combined with the random shutdown variability resulted in inventory build-up in the line flow as the highly automated workstation became a bottleneck in the system. All of a sudden, workers at downstream stations could do their steps faster than the machine doing its step, because the speed of the machine is pretty much ‘set.’ The entire workflow therefore had to be reconceived and rebalanced.

Continuous improvement efforts focused specifically on the new machine workstation to lower its operation cycle time. Improvements included changing some clamps and bits to cut through metal faster, applying better lubrication of the tooling used for cutting, and 3D printing certain vices to secure new parts before they would enter the cutting unit (the latter is a Lean practice called Single Minute Exchange of a Die (SMED)). This improved the machine’s speed, however, nothing could be done to improve its lack of flexibility. For future investments, Walters & Wolf will consider using less sophisticated but right sized machines to suit the production system they will operate in, perhaps keeping three stations instead of consolidating all the work at one station. This way, their automation would be much simpler, but their line’s production speed could increase, and they would still employ people who are thinking, making judgments, and constantly improving their work station.

As far as longer-term impacts are concerned, consider that “a new shiny thing” does not stay that way for long. Equipment manufacturers continue to make newer and better machines, and they stop supporting older ones. They may design for planned obsolescence, assuming that the buyer’s calculation of an ROI is based on a service life of the machine that equals its depreciation life (e.g., 5 years) and that they have a repetitive production line that is working 24/7 over those years. However, Walters & Wolf is an engineered-to-order and fabricated-to-order company. They cannot maximize the utilization rate of everything they own, and they take good care of their assets, e.g., by practicing Total Productive Maintenance (TPM). Employee input is vital to this process. Regular use of Plan-Do-Check-Act (PDCA) learning to improve their TPM processes has resulted in improved stability and throughput, and downtime reduction for scheduled and non-scheduled maintenance. As a result, Walters & Wolf’s machines can last 15 years if not longer. Over that time, replacement parts availability becomes an issue, as does lack of software support. They have had to switch the entire operating system on some machines in order to keep them working and maintain AutoCAD compatibility. Tech moves fast!

Through this experience integrating a 16-axis cutting machine into their fabrication process, Walters & Wolf employees got to better understand the performance characteristics of their production system’s design and future IC automation considerations. An operations science mindset could have made them more aware of shifting bottlenecks [38]. Perhaps other IC investments would have made sense had the company conducted a more analytical production system study up-front, before acquiring assets.

The third case describes a company that benefited from up-front study of their project production systems and application of operations science principles.

The third case pertains to Binsky & Snyder, a mechanical specialty contractor established in 1938 and based on the east coast of the US [39]. The company serves traditional construction- but nowadays mainly tech markets, building pharmaceutical and life science facilities, research laboratories, medical facilities, and data centers. The company’s CEO learned about Project Production Management (PPM) and Production System Optimization (PSO) about 3.5 years ago, and has since started to implement these in his company [12], [40], [41]. They are driving the development of their Binsky Production System by focusing on building processes (fabricating or manufacturing, installing, commissioning, and starting up), rather than on administration processes (bidding, handling requests for information (RFIs), billing, communicating via email, etc.).

The demands from a very large project forced them to think outside of the box and offered them the opportunity for implementation of production thinking, starting from engineering all the way to installation and project completion. This raised questions such as: How do we make fabrication (more like) manufacturing? How do we create components? What modules can we prefabricate? How do we define a bill of process with clearly identified steps so we can measure their duration and inventories in-between? How do we control the flow and work-in-process (WIP), and release it to the field in a way that makes them the most productive? How do we reduce the time spent on field installation? Spoiler alert: by mapping and then rethinking their fabrication process and using Production System Optimization, they brought this time down from 130-140 days to 50 days.

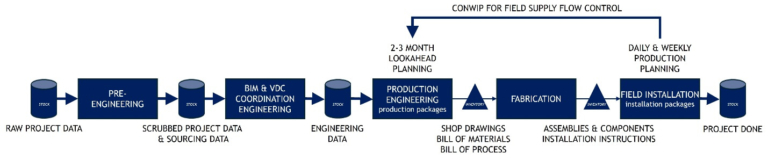

Figure 1 illustrates Binky & Snyder’s workflow for a project. The upfront part of the workflow is all push-driven. They have to push because of the conflict between BIM coordination efforts done area by area, and Binsky & Snyder’s work based on systems. The workflow starts with the receipt of raw project data that needs to be scrubbed and supplemented by sourcing data, so that a comprehensive building model can be produced. This model is then coordinated with other trades. The outcome of the coordination process is a stock of engineering data. The latter part of the workflow is throttled by the use of a constrained WIP (ConWIP) signal [42], [43] that emanates from the daily- and weekly production planning done by field personnel, and feeds into production engineering. The production team uses a 2 or 3-month lookahead planning process to make work ready as per the Last Planner® System [44]. In the process of production engineering, the job is broken down into production packages including shop drawings, bills of materials, and bills of processes. These define batches of work that, based on the ConWIP signal, are released and then flow to fabrication and field installation.

Relatively recently, the company moved from a smaller fabrication shop to a new one of 130,000 ft2 in New Jersey. The new facility allowed for sophisticated automated equipment, and wireless connectivity provided for flexibility in reconfiguring the layout as needed [45].

The first step towards optimization was to assess the current state. A production coordination manager was therefore designated and started documenting their work in the shop and in the field using process mapping. The goal of mapping was to gain deep understanding of all the steps that make up a fabrication or construction process. In turn, these maps helped them understand various projects’ demands for materials and the shop’s capacity to fulfill them. The maps also informed decisions about what to standardize (i.e., establish a bill of process that can serve from one project to the next) and how to automate certain process steps so as to reach a desired future state.

Investments in sophisticated equipment were considered, informed by project production system optimization. Investment in a pipe cutting machine is a no-brainer because the raw time difference between someone cutting a hole in a pipe by hand versus doing it by machine is so big. In contrast, investment in an automatic welding machine is not so clear-cut. While one may think an automated machine can be so much more productive, a production system study comparing hand-welding with automated welding in a line-flow or job-shop setting may indicate that the ROI does not meet expectations unless, perhaps, this step is truly the bottleneck in the system.

Binsky & Snyder’s production coordinator wants to get on a project as early as possible to assist with the process design and share with the owner various production scenarios (as they would be as a trade partner on an Integrated Project Delivery project). The reason is that they “know pipe the best and construction managers and general contractors are great administrators, but they do not necessarily understand the full scope of our work to the detail that is necessary to really sequence it out and try to save as much time and as much money as possible for the owner” [41]. During this early engagement they can run analytical models on what their capacity should be and how much WIP is actually hampering their productivity; it is not uncommon to find that increasing the capacity allocated to a certain fabrication process will in fact lower the productivity overall [41]. The findings of production system modeling and simulation can be counterintuitive. This is in part because the underlying concepts of operations science are not yet so well-known and understood, and because the construction systems being modeled are complex and exhibit emergent behaviors.

The three cases presented in this paper illustrated a range of rationales and approaches in the adoption of IC.

The Katerra case described production system characteristics (product variety, supply chain complexity, capacity, balancing of supply and demand, etc.) at a very high level. It appears that Katerra leadership did not consider operations science principles in their dealmaking activities.

The second case looked at Walters & Wolf’s production system up-close. It described how the introduction of a new piece of IC equipment in the fabrication shop’s production system changed the fabric of that system and, with it, changed that system’s performance characteristics (cycle time, capacity, bottlenecks, workload balancing, etc.). The company president reflected: “It probably would have been just fine if we had not focused on flow and were not trying to level the line and constantly try to improve our cycle time” [37]. In other words: the disruptive impact of the IC automation might not have been obvious to people unfamiliar with project production system optimization. As mentioned in the Introduction, a local IC implementation does not necessarily benefit performance at the production system level. Despite their deep knowledge and appreciation of flow-based production, Walters & Wolf learned that the introduction of automation was more disruptive than they had anticipated.

Finally, the third case was situated at a level of abstraction in-between the two other cases. Specialty contractor Binsky & Snyder views a project as a project production system to be optimized. By far their biggest challenge is variability in demand. Demand from a very large project offered them the opportunity to begin implementing project production thinking. Given that their shop can serve multiple projects at the same time, their next step is to apply that thinking and optimize workflows while taking into account that multiple projects will compete for shop capacity.

All companies at the heart of these cases are project producers. They make products and deliver services to customers (as opposed to investors, who are just curious about what IC can deliver). Nevertheless, but not surprisingly, the use cases for IC differed among them as per their business needs.

Individual companies or investors will want to explore and clearly articulate their rationale(s) and approach(es) for moving towards IC. This will determine what investments are suitable for their circumstances, given what they can invest in.

This paper described three companies that invested in IC, pursuing a variety of rationales and achieving different degrees of success. Acquiring hardware tends to be the ‘easy’ part. IC investments of companies that are in the business of producing goods and delivering services can be grounded and validated by fine-tuning the companies’ production system design(s), founded on operations science principles, and accompanied by people’s know-how and ways of working (processes).

A takeaway from the literature and interviews conducted for this paper is that production system design is seldom mentioned. Moreover, when there is an opportunity to rethink the business case it may be possible to also rethink the entire system’s design (e.g., [46]). In our view it is crucially important for companies that pursue IC to apply operations science to optimize their project production systems’ performance. The development of models will be useful when studying alternative production system design configurations and testing them in real time, taking into account the company’s position in the value stream(s) for their project(s).

While all companies are governed by operations science principles—e.g., there is no escaping from Little’s Law that states that WIP equals throughput times cycle time [2], [3]—only some companies are effectively applying these principles to manage their operations. All companies would benefit from doing so when striving for project production system optimization.

As others have argued already (e.g., [44]), the adoption of IC provides an opportunity to cause a paradigm shift in the industry. The shift is made possible when companies judiciously take advantage of the opportunities IC offers (e.g., [33], [39], [38]). This shift must include the involvement of production system design engineers who can make use of operations science to tailor the AEC industry’s production systems to the desired performance levels.

We owe many thanks to Nick Kocelj (Walters & Wolf) and Bob Snyder Jr. (Binsky & Snyder) for making time to be interviewed and sharing thoughts on their company’s project production systems, lessons learned with IC implementation, and production system optimization. This study of IC and the companies presented in this paper was supported by membership contributions from the Project Production Institute (PPI) and other companies to the Project Production Systems Laboratory (P2SL) at the University of California, Berkeley. We express our sincere thanks for all the support we received. Any opinions, findings, conclusions, or recommendations expressed in this paper are those of the authors and do not necessarily reflect the views of the interviewees or supporting organizations.

[1] PPI, "Industrialized Construction," Project Production Institute, [Online]. Available: https://projectproduction.org/glossary/industrialized-construction/. [Accessed 1 May 2025].

[2] W. J. Hopp and M. L. Spearman, Factory Physics, Third ed., Waveland Press, 2011.

[3] M. L. Spearman and W. J. Hopp, "The Case for a Unified Science of Operations," Production and Operations Management (POMS), vol. 30, no. 3, pp. 802-814, 2021.

[4] M. Thompson, "DfMA Overlay to the RIBA Plan of Work (2nd edition)," Royal Institute of British Architects (RIBA), London, UK, 2021.

[5] MMC, "Modern Methods of Construction: Introducing the MMC Definition Framework," MHCLG Joint Industry Working Group on MMC, UK, 2019.

[6] G. Bryan, C. Carlson, S. Gaponenko and S. Mitra, "The Benefits of Modeling and Optimizing Production Systems: An Application on Civil Infrastructure Projects," 30 October 2023. [Online]. Available: https://curt.org/2023/10/30/the-benefits-of-modeling-and-optimizing-production-systems-an-application-on-civil-infrastructure-projects/. [Accessed 15 July 2025].

[7] Project Production Institute (PPI), "Five Levers of Production System Optimization. PPI Technical Guide 01," December 2020. [Online]. Available: https://projectproduction.org/wp-content/uploads/2021/01/PPI-Technical-Guide-01-Five-Levers.pdf. [Accessed 15 July 2025].

[8] G. Prado Lujan and I. D. Tommelein, "Application of Operations Science to Design a Project Production System: A Case Study in Building Construction," in Proceedings of the First Annual Conference of the Project Production Institute, 2023.

[9] B. Zhang and M. Fischer, "Matching Supply with Demand: A Case Study Implementing Production System Optimization for Offsite Construction," in Proceedings of the Second Annual Technical Conference of the Project Production Institute, 2024.

[10] I. D. Tommelein, "Pull-driven Scheduling for Pipe-Spool Installation: Simulation of Lean Construction Technique," Journal of Construction Engineering and Management, vol. 124, no. 4, pp. 279-288, 1998.

[11] I. D. Tommelein, "Process Benefits from Use of Standard Products - Simulation Experiments using the Pipe Spool Model," in Proceedings of the 14th Annual Conference of the International Group for Lean Construction (IGLC 14), Santiago, Chile, 2006.

[12] R. B. Snyder Jr., Interviewee, CEO, Binsky & Snyder. [Interview]. 18 July 2025.

[13] R. M. Solow, "We’d Better Watch Out," New York Times Book Review, p. 36, 12 July 1987.

[14] M. Krishnan, J. Mischke and J. Remes, "Is the Solow Paradox Back?," McKinsey Quarterly, June 2018.

[15] P. Akers, "The American Innovator," [Online]. Available: https://www.youtube.com/.

[16] C. Zakrzewski, "Former Flextronics CEO Takes On Construction," 13 April 2017. [Online]. Available: https://www.wsj.com/articles/former-flextronics-ceo-takes-on-construction-1492083002.

[17] Anonymous, "Least Improved: The Construction Industry," The Economist, 19 August 2017.

[18] P. Dvorak and J. Steinberg, "SoftBank-Backed Katerra Files for Chapter 11," The Wall Street Journal, pp. https://www.wsj.com/finance/softbank-backed-katerra-files-for-chapter-11-11623060434, 7 June 2021.

[19] K. Brenzel and D. Jeans, "Warped Lumber, Failed Projects: TRD Investigates Katerra, SoftBank’s $4B Construction Startup," The Real Deal, 16 December 2019. [Online]. Available: https://therealdeal.com/2019/12/16/softbank-funded-construction-startup-katerra-promised-a-tech-revolution-its-struggling-to-deliver/. [Accessed 13 January 2023].

[20] N. Berg, "This Prefab Builder Raised more than $2 Billion. Why did it Crash?," Fast Company, 7 June 2021. [Online]. Available: https://www.fastcompany.com/90643381/this-prefab-builder-raised-more-than-2-billion-why-did-it-crash visited. [Accessed 17 August 2022].

[21] K. Putzier and B. Eliot, "How a SoftBank-Backed Construction Startup Burned through $3 Billion," The Wall Street Journal, 29 June 2021.

[22] Wikipedia, "Katerra," Wikimedia Foundation, [Online]. Available: https://en.wikipedia.org/wiki/Katerra. [Accessed 15 May 2025].

[23] GCR Staff, "American Start-up Katerra to Build 4,100 Prefab Homes in Saudi Arabia," Global Construction Review, Chartered Institute of Building (CIOB), 24 May 2019. [Online]. Available: https://www.globalconstructionreview.com/american-start-katerra-build-4100-prefab-homes-sau/.

[24] GCR Staff, "Prefab Builder Katerra Picked for Tech Office Block in India," Global Construction Review, Chartered Institute of Building (CIOB), 25 November 2019. [Online]. Available: https://www.globalconstructionreview.com/prefab-builder-katerra-picked-tech-office-block-in/.

[25] Katerra, "Fabricating Next Generation Building Components and Assemblies," [Online]. Available: https://katerra.com/en/how-we-do-it/our-factories.html. [Accessed 2 April 2018].

[26] D. Davis, "Katerra’s $2 Billion Legacy," Architect Magazine, 18 June 2021. [Online]. Available: https://www.architectmagazine.com/technology/katerras-2-billion-legacy_o#.

[27] S. McBride , "SoftBank-Backed Katerra to Cut 200 Jobs, Close Arizona Factory," The Wall Street Journal, 03 December 2019.

[28] K. Slowey , "Katerra Plans more Advanced, Autonomous Prefab Plant," Construction Dive, pp. https://www.constructiondive.com/news/katerra-plans-more-advanced-autonomous-prefab-plant/527725/, 13 July 2018.

[29] GCR Staff, "Offsite Pioneer Katerra to Close Original Component Factory in Phoenix," Global Construction Review, Chartered Institute of Building (CIOB), 12 April 2019. [Online]. Available: https://www.globalconstructionreview.com/offsite-pioneer-katerra-close-original-component-f/.

[30] J. Caulfield, "Katerra, a Tech-driven GC, Plots Ambitious Expansion," Building Design + Construction, 4 March 2018. [Online].

[31] S. Obando, "Katerra Sells Factories, Office in Deals Worth $71.25M," Construction Dive, 09 August 2021.

[32] H. Lidelöw, Interviewee, Chief Technical Officer, VBC. [Interview]. 21 May 2023.

[33] Walters & Wolf, [Online]. Available: https://waltersandwolf.com. [Accessed 15 07 2025].

[34] NEXT Energy Technologies, Inc., "NEXT Energy Technologies Delivers Solar Prototype Window Wall to Integration Partner Walters & Wolf," 27 April 2022. [Online]. Available: https://www.nextenergytech.com/post/next-energy-technologies-delivers-solar-prototype-window-wall-to-integration-partner-walters-wolf.

[35] FastCapLLC, "Lean Manufacturing Factory Tour - Walters & Wolf," The American Innovator, 21 June 2014. [Online]. Available: https://youtu.be/c_g8JYFrS98. [Accessed 15 July 2025].

[36] FastCapLLC, "Walters & Wolf Tour," The American Innovator, 10 April 2015. [Online]. Available: https://youtu.be/FPJAzY2xhcc. [Accessed 15 July 2025].

[37] N. Kocelj, Interviewee, President, Walters & Wolf. [Interview]. 7 July 2025.

[38] C. Roser, K. Lorentzen and J. Deuse, "Reliable Shop Floor Bottleneck Detection for Flow Lines through Process and Inventory Observations," in Procedia CIRP, Robust Manufacturing Conference (RoMaC 2014), 2014.

[39] Binsky, "80 Years of Proven Success in Mechanical Contracting," [Online]. Available: https://www.binsky.com/. [Accessed 01 June 2025].

[40] R. B. Snyder_Jr. and G. Fischer, "Bob Snyder Conversation," 7 March 2025. [Online]. Available: https://projectproduction.org/ppi-conversations/transforming-construction-the-future-of-production-management/, https://youtu.be/Hd4HcW1gOa4. [Accessed 15 July 2025].

[41] B. Snyder III and G. Fischer, "PPM Principles in Action: Bob Snyder III Explores Binsky’s Production Management Success. A PPI Conversation with Bob Snyder III and Gary Fischer, PE," 10 June 2024. [Online]. Available: https://projectproduction.org/ppi-conversations. [Accessed 15 May 2025].

[42] R. Arbulu, "Application of PULL and CONWIP in Construction Production Systems," in Proceedings of the 14th Annual Conference of the International Group for Lean Construction (IGLC14), Santiago, Chile, 2006.

[43] W. J. Hopp and M. L. Spearman, "To Pull or Not to Pull: What Is the Question?," Manufacturing & Service Operations Management, vol. 6, no. 2, pp. 133-148, 2004.

[44] G. Ballard and I. D. Tommelein, "2020 Current Process Benchmark for the Last Planner System of Project Planning and Control," Project Production Systems Laboratory, Berkeley, CA, 2021.

[45] Verizon, "Binsky & Snyder Manufacture a Dynamic Future with a Private Wireless Network," [Online]. Available: https://www.verizon.com/business/resources/customer-success-stories/binsky-and-snyder-manufacture-a-dynamic-future-with-private-wireless-network. [Accessed 16 June 2025].

[46] O. D. Krieg and O. Lang, "Adaptive Automation Strategies for Robotic Prefabrication of Parametrized Mass Timber Building Components," in Proceedings of the 36th International Symposium on Automation and Robotics in Construction (ISARC 2019), Banff, Alberta, Canada, 2019.