Autonomous vehicles—on the road, in the air, or over the water—are expected to disrupt business processes, operating costs, and economic models. Logistics and supply chain operations will be deeply affected, as will the relationship between service providers and customers.

If autonomous vehicles are to come into wide use, an array of complementary services and technologies will be needed to support them. These autonomy “ecosystems” will echo in many ways the businesses, technologies, jobs, and services that developed following the invention and then the widespread use of automobiles, trucks and airplanes.

Although this scenario may seem like it is far in the future, it’s important to understand how autonomous technology could radically change a company’s operating model and value proposition. Supply chain leaders in particular should start thinking now about how their companies and employees can participate in these revolutionary new opportunities.

Keywords: Value Stream; Value Stream Map; Demand; Flow; Transformation; Stock; Production

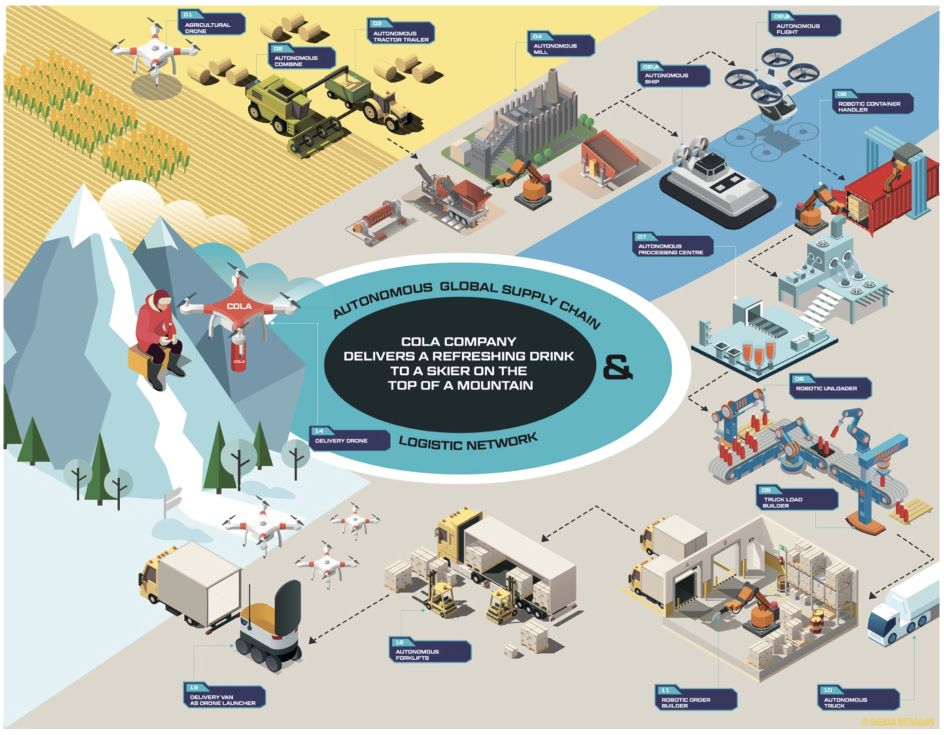

Autonomous vehicles and robots have long been associated with science fiction, and many people still consider them to be something they will not have to deal with in their lifetime. Most likely that’s because, until recently, robots were stationary, expensive and unintelligent, and they performed very basic functions. Today, though, developments in machine learning and artificial intelligence, big data, mobility, and advanced sensors have made the use of autonomous vehicles feasible. Thanks to these advances, robots will soon be operating delivery vehicles, distribution centers, and factories. The scenario in Figure 1, in which robots and autonomous vehicles operate both consecutively and collaboratively to create an autonomous supply chain (solving the problem of how to get a hot drink to a skier stuck on a mountain top, as illustrated in Figure 1), is not as far from reality as one might think. Every activity in this scenario is already being tested today. At some point, this kind of fully autonomous, end-to-end supply chain will become a reality.

Figure 1- Autonomous Supply Chain example

Autonomous vehicles could help supply chains respond faster and more nimbly to customer demand. Because autonomy enables machines to make decisions and act on their own, supply chain speed and productivity will be significantly enhanced.

Business leaders should not wait for this revolution to happen. Instead, they must consider two main questions:

These two questions are intertwined, and to answer one requires considering the other. An Operations Science perspective can provide insights into where autonomous technology will have greatest impact.

The term “autonomous vehicle” refers to any machine that is able to move, either on its own as directed by software or through remote control by a human operator, in order to complete tasks. Autonomous vehicles include machines of all sizes, from delivery drones small enough to be held in an operator’s hands to huge oceangoing ships.

As shown in Figure 2, autonomous machines in the supply chain operate in four general environments:

Figure 2: Autonomy Landscape

The number of autonomous machines that support logistics and supply chain activities is growing rapidly. Some, like automated guided vehicles and robotic pickers in manufacturing and warehouse facilities, are already in wide use, while others, such as “parcelcopter” drones and self-driving trucks and cars are still in development. But those are just the obvious ones. Many other types of vehicles have the potential to become autonomous and make logistics and supply chain activities more efficient and cost-effective or less resource-intensive. These include both existing types of machines and entirely new categories of vehicles that are being developed and tested. Examples of the latter include autonomous delivery bots, order-picking carts, and retail inventory-scanning and order-replenishment robots, to name just a few. Clearly, autonomous vehicles have the potential to bring revolutionary improvements to almost every node in the supply chain.

Autonomous systems have the potential to reshape supply chain operations and improve performance in three basic ways:

From an internal operations perspective, autonomous vehicles could improve efficiencies and reduce costs in almost every supply chain pathway and node. From an external, customer-facing perspective, they could help companies better meet customers’ delivery requirements. From an Operations Science viewpoint, the technology offers the prospect of reducing variability, increasing capacity, and reducing cycle time for different myriad activities that comprise supply chain activities. For example, automation in sorting offers the prospect of reducing variability (greater reliability than human sorting, fewer errors), greater capacity (work longer hours than individual humans) and shorter cycle times (process times for individual sorting faster).

The potential supply chain applications for autonomous vehicles are almost unlimited. For example, drones could carry out dangerous work, such as inventory counting in the higher reaches of warehouses or gathering information during natural disasters and relaying it to human decision makers. Self-driving delivery vans could reduce the high cost of last-mile delivery in e-commerce, while autonomous scheduling and dispatching of on-demand deliveries and transportation would reduce lag times and speed responses. Autonomous vehicles could transport disabled people to work, expanding the labor pool for warehouses and other supply chain jobs. In all these examples, the same operations science improvements – variability reduction; capacity increase; shorter cycle times – are all at play for every example cited.

Those are just a fraction of the many possible scenarios, of course. No matter how a company chooses to introduce autonomous technology, it will be obliged to rethink its operating model and value proposition. The freight transportation industry, where autonomous vehicles are already being tested, provides a useful example. Self-driving trucks would have no hours-of-service limitations, making assets usable 24 hours a day. This could alleviate the driver shortage in the United States and help to ease growing pressure on trucking capacity. That, in turn, could prompt shippers to think of new ways to hire and utilize the trucks. For instance, a consortium of shippers might bid on a transportation asset, and each member would own part of the asset or pay a set percentage of the cost of the move. In such cases, companies would have to restructure their service-level agreements to reflect that they are using and paying for just a fraction of the vehicle.

It’s critical to consider how autonomous vehicles integrate with and influence other functions, policies, and technologies. Right now, most enterprises look at autonomous technologies in isolation. Yet, even if the activity performed by the autonomous vehicle is geographically limited, it will impact other operational and administrative areas.

Warehouse drones that assist with inventory counting—by taking pictures of bar codes associated with storage slots, collecting information about the items in those slots, and sometimes processing that data—provide a current example. In the United States, even when operation is limited to inside the warehouse, compliance with Federal Aviation Administration (FAA) regulations is required. If the drones operate in the same space as workers, then Occupational Safety and Health Administration (OSHA) regulations apply. In warehouses and data centers that lack built-in technology infrastructure, the operator may have to install sensors, transmitters, location mapping and tracking software, and other technology to enable drones to function. And it will be necessary to hire people with the skills and knowledge to operate the drones and mesh all of the supporting technologies together.

A related consideration is the need for technical and operating standards. Autonomous vehicles depend on an array of technologies, such as computer processing, sensors, batteries, the Internet of Things, machine learning, wireless communication, and software applications and algorithms, among others. How could they all integrate with each other, and could that solution be universally adopted? One potential approach would be an open platform where companies could offer their own apps; this is similar in concept to the way apps have been developed based on Apple’s iOS and Google’s Android operating systems.

I believe a common operating system that would facilitate “plug and play” applications will be critical for preventing vehicles of all types from operating in conflict with each other. Common standards will be needed to provide operators with the ability to gather information from any kind of sensor, analyze that data, and respond in predictable ways that conform to established norms. To ensure safety, it will also be necessary to embed algorithms that govern how a vehicle will behave when it encounters specific situations or environments.

Technology and safety standards are far from the only consideration supply chain leaders must contemplate. One issue that could have a critical impact on successful applications of autonomy is how human beings will interact with autonomous vehicles. There are three main focal points of this very important concern: safe vehicle operation, the impact on employees and customer satisfaction.

When it comes to vehicle operation, there is no universally accepted opinion how autonomous systems should be designed. One approach keeps humans completely out of the loop; this is the route taken by Google’s autonomous car division. Another approach has autonomous systems and humans jointly making decisions, arguing that it takes advantage of people’s ability to manage new or unexpected situations. However, companies that decide to include human beings will have to be careful. Some research has found that people often get bored or complacent if they aren’t operating the machine, and thus are not effective monitors of autonomous systems [1]. For safety’s sake, human monitors must remain engaged.

It’s understandable that people would worry about how autonomous technologies will affect them personally, and companies will have to be sensitive to employees’ concerns about automation taking away their jobs (a topic that will be discussed further in the following section). UPS is already dealing with this: The Teamsters union, which represents the company’s drivers, has demanded that UPS not use drones or driverless vehicles to make deliveries. The drivers’ worries are understandable. But the continuing driver shortage is making it difficult for UPS and other carriers to deliver the surging volumes of e-commerce shipments, especially during the holiday season. The question for the carriers is whether they will be able to use autonomous technology to mitigate the labor shortage without alienating employees and, potentially, leading to a strike or other labor action.

And finally, it’s imperative that companies devote careful attention to how autonomy could affect the customer experience. Automation will remove some of the typical points where humans interact in a transaction that delivers a product or provides a service. What if customers don’t interact naturally or favorably with a robot, or the robot is unable to correctly interpret the customer’s speech and behavior? How will this affect customer service quality and, in turn, customer loyalty and retention? Until robots are capable of understanding body language, facial expressions, and the difference between sincere speech and sarcasm, businesses will have to continue person-to-person interactions with their customers.

Debates over the potential implications of artificial intelligence (AI) for businesses, individuals and for society as a whole are raising questions about the adoption of technologies that replace or supplement human agency. Among the biggest concerns is that autonomous technology will take away many jobs, and that this could have a profound impact on the social fabric.

Autonomy inevitably will reduce or eliminate some jobs. In my view, however, we should focus not on the prospect of lost jobs but on the more likely scenario: that autonomy will change the knowledge and skills required for many existing jobs while also creating new jobs and professions. These will develop within the context of autonomy “ecosystems”—the products, services, and technologies that will develop in order to support and enable the widespread adoption of autonomous systems. Something similar has happened in the past. When the first automobiles came on the market, there was little to no highway, toll, and parking infrastructure, and fueling stations were rare. There were very few auto mechanics, technicians or driving instructors; no specialized auto insurance and financing; and no such thing as vehicle-related software and electronics or aftermarket parts retailers. All of these, or something like them, will be required for autonomous vehicles to scale up and be viable.

Some of these complementary businesses will develop far in the future, while others will be feasible relatively soon. Many examples come to mind, but it’s impossible to consider every possibility here. The following overview of the ecosystems we are most likely to see (also shown in Figure 3) will provide a sense of the opportunities and the challenges that lie ahead.

Figure 3: Autonomy Ecosystem Overview

As autonomous vehicles become more common, we will see new financing models based on ownership or asset usage. Ownership models might include full or fractional ownership or other arrangements such as rentals or pay-per-use. Financing based on asset use would reflect how the end user will deploy the vehicle. Users will have to decide what financing model will make the most sense for them—pay as you go, fractional ownership, or full ownership. They’ll also have to consider what kind of partnership they should leverage to maximize the use of the financed assets. For example, companies operating on the same lane could share assets; they could finance fixed capacity to spread capital costs and depreciation across the partners, thereby reducing the overall cost of operations. In addition to traditional vendors like banks, vehicle manufacturers, fleet providers, and insurance companies will also offer financing. There will be a need for specialists who understand the implications of autonomy for vehicle-finance products and its offerings.

Insurers will have to create an entirely new class of vehicle insurance that is not based on driver attributes or behavior. They will, however, have to account for human interfaces and interactions with the autonomic processes. Pricing could be based on usage (per trip, for example) or on such considerations as the type of activity, product, operating system, transport mode, or safety record and standards. If vehicles have shared ownership, leasing, or other similar arrangement, then insurance instruments will have to be designed for those situations. Traditional insurance functions such as pricing and claims processing and management will need specialists who are well versed in how autonomous vehicles operate.

Companies that manage fleets of autonomous vehicles could include third-party service providers, original equipment manufacturers (OEMs), and vehicle distributors. Fleet managers will be responsible for many tasks that exist today, such as tracking and monitoring asset location, vehicle routing and scheduling, preventive maintenance, management of parts inventory, incident management, collection and management of driving and maintenance records, vehicle acquisition and insurance, and cleaning services. Because the vehicles will be using various types of sensors to provide real-time information, some of those responsibilities will become more predictive than they are now, and new responsibilities, such as software synchronization, will develop. A big question will be how fleet managers will gain the skills they need to handle autonomous vehicles’ new technical requirements.

There will be a need for suppliers of parts, maintenance and repair services, vehicle recovery and recycling, fueling system upgrades, and recall management, just as there is for conventional vehicles today. Because assets will be driven by software, maintenance will largely consist of operating system management, sensor data interpretation, and sensor replacements. Specialized technical training will be required to upgrade the skills of the current workforce; it could be provided by the asset owner or leveraged from external providers. Managing inventories of specialized electronic parts and providing the highly skilled labor required for the repair and upkeep of autonomous vehicles will be early business opportunities.

The development of technology, infrastructure, and systems for traffic management and the safe operation of vehicles will be the joint responsibility of the private and public sectors. Just a few examples include: routing design to delimit where vehicles may operate; infrastructure upgrades to ensure adequate data-collection and -transmission capabilities; operating control centers that function similarly to air-traffic control centers for aircraft; developing and implementing protocols for seamless “hand-offs” of control as vehicles leave one control center’s jurisdiction and enter another; and providing services like traffic-signal integration to maintain synchronous movement of autonomous vehicles. Experts will be needed to establish new traffic and safety policies and regulations for such issues as “cohabitation” of autonomous and non-autonomous vehicles on roadways and to manage harmonization among national, state, and local governments. Cybersecurity specialists will be in big demand due to the need to protect the assets in motion.

Software available as applications on customers’ own devices or on the vehicle and accessed via touchscreen, for instance, will help to improve the customer’s interaction with the vehicle and/or the delivered product. There are many possibilities, but some obvious opportunities include navigation, digital payment, content streaming, messaging, e-commerce links, and communication with a connected home or office. Applications could be delivered via an open platform, similarly to the way third-party apps have been developed for Apple’s iOS and Google’s Android. An entire company could be built around developing a software “fabric” that would make “plug and play” both feasible and easy. App developers’ jobs probably won’t change much, but their skills will be in greater demand.

Parking could change significantly when humans are no longer directly controlling the vehicle. For example, parking structures today are designed for human access throughout the structure. In an autonomous world, vehicles could drive in and out of the parking garage by themselves, so a lower ceiling clearance and more space for vehicle parking might be feasible. It’s likely that almost all self-driving cars will be electric; they are easier to control with computers, and they will comply with ever-tighter fuel-efficiency requirements. Thus, operators of parking lots or structures for autonomous vehicles could enhance their revenue picture by providing battery charging services. In addition to purpose-built parking facilities, retailers could potentially use empty parking lots as overnight parking stations for autonomous vehicles, while distribution centers could use their lots to park and charge autonomous trucks.

In the future, automated toll-collection systems that can communicate with autonomous vehicles will have to be not just ubiquitous but also harmonized. That’s because autonomous assets need a smooth flow and pace to maintain their coordinated movement; an out-of-synch toll reader could potentially cause traffic logjams. Universally accepted “smart” readers, “smart” license plate tags, assessment regimes, entry/exit verification, and payment links will support safe operation and equitable tolling of autonomous cars and trucks. This will create new jobs for engineers and state and local transportation departments. In light of the shared ownership and operating models that are expected to develop, the question of who will pay the toll—the asset owner, service provider, or the vehicle user—could prove more complicated than current payment regimes.

Companies will use drones, delivery bots, and autonomous highway vehicles to facilitate commerce via two main pathways. The first involves industrial applications, some of which are already in use or are being tested. Examples include using drones for inventory and asset counting in warehouses and freight transportation, and robots for inventory counting and retail shelf replenishment. The second involves delivering products and services directly to consumers. For example, passenger vehicles could provide e-commerce ordering and pickup opportunities to commuters. “Delivery logistics”—autonomous vehicles bringing products directly to the consumer—could act as a platform for on-the-spot ordering of the next delivery. Drones could carry returned goods or product packaging back to their home base. Autonomy could help companies overcome a lack of capacity or labor and possibly provide services more quickly and efficiently than humans do now. However, companies will still need to preserve customer intimacy and satisfaction while ensuring that promises to the customer will be accurately fulfilled. The “human touch” will still be needed for a long time to come.

Fueling stations will have to be designed, built, and operated specifically for driverless vehicles. These could be operated by vehicle manufacturers, energy companies, third-party vendors, retail outlets, or even through crowdsourcing (such as by offering homes as charging points for electric vehicles). Almost all autonomous vehicles will be electric, which raises such questions as: How will companies dispense and charge for fuel? And will the infrastructure support power requirements for every type of vehicle being operated?

Both traditional manufacturing and three-dimensional (3D) printing will be required to produce autonomous vehicles. OEMs will have a number of options, including controlling manufacturing from “design to delivery,” becoming a mass producer of designs developed by other companies, assembling and integrating components from multiple sources, or building individual vehicles to order. Engineers, construction companies, machinery manufacturers, and systems integrators will be needed to either build new factories or retool old ones to manufacture autonomous vehicles at scale. Other business opportunities will open up relative to the delivery of vehicles to the customer, directly, through an existing dealership network, a third-party seller, or a retailer. In an autonomous vehicle manufacturing plant, some jobs, such as product design and quality compliance, will remain essentially the same. Others—robotics mechanic and algorithmic operations, for instance—will be unique to autonomous technology.

Autonomous vehicles will generate, send, and receive enormous amounts of data to and from a “home base,” other vehicles, and local communications infrastructure. As the number of autonomous vehicles grows, the need to collect, store, analyze, and distribute the data they create will grow as well. To support new autonomic processes, extensive data infrastructure will be needed, including readers, edge computing devices, sensor networks, and much more. Additionally, with public safety at stake, managing governance and access to that data will be critical. All of this will lead to numerous business opportunities involving hardware, software, data management, and data security. Systems architects, data scientists, cybersecurity specialists, and other information technology (IT) professionals will be in high demand.

No matter how common autonomous vehicles become, there will still be jobs for people with skills in three main areas: technology, knowledge sciences, and operations. Some of those jobs will be completely new, while some exist now but will be transformed by autonomy. Many autonomy-related jobs will support supply chain functions. (For a list of some of the possibilities, see Figure 4.) The following are just a few examples:

Figure 4: Supply Chain Possibilities

Some current jobs will translate well to autonomous vehicle ecosystems, while others will not. Even auxiliary functions like legal services and human resources will require rethinking. Training and education that are specific to autonomy represent a huge business opportunity. Educators will need to develop educational curricula and skills certifications that can support autonomous technologies as well as determine what training strategies will be effective in preparing the workforce for autonomy-related jobs. These might include apprenticeships, university and community college courses, professional certifications, and “learn by doing” programs. Additionally, a consortium of industry, educators, and professionals may prove to be the best resource for developing training programs. An intriguing question will be whether technologies like blockchain could play a role in credentialing.

Why would companies want to participate in autonomy ecosystems, rather than (or possibly in addition to) creating the autonomous vehicles themselves? The kind of collaboration required to develop these complementary systems will breed innovation that will support the people and organizations focusing on the core problem. An ecosystem business will also be an asset-light way to transition into autonomy; companies can invest in what makes business and economic sense, and not get weighed down with heavy investments too soon. Additionally, autonomy will be a major, sweeping transformation, and it would be almost impossible to own all the pieces of the puzzle. Participating in one or more of the ecosystem areas will allow companies to master one segment at a time and expand where and when they see an advantage.

Four major components will play a key role in determining whether these ecosystem businesses succeed or fail. The first is technologies that complement or support the vehicle. Complementary technologies would include things like routing algorithms, traffic-control systems, and customer interfaces. On the support side would be things like launch pads, batteries, and other infrastructure.

Further to the subject of infrastructure: In the autonomy context, this refers to two things that are interrelated: physical infrastructure such as warehouses and factories designed to accommodate autonomy-related businesses, and information technology (IT) infrastructure that enables the collection, processing, and sharing of autonomy-related data. Both types of infrastructure will have to be upgraded to support real-time data processing without latency and to handle the enormous volumes of data these systems will generate daily—indeed, hourly. For instance, in the case of physical infrastructure, real estate owners could offer fully equipped premises and related services to support autonomic processes. On the technology side, upgraded infrastructure (such as edge and sensor “fabric” and data storage, communication, and connectivity) will be needed to support the critical technologies that will make autonomy both possible and reliable: computer vision, sensor technology, Internet of Things, artificial intelligence, machine learning, robotic process automation, and virtual and augmented reality.

The second major component is an end-to-end operating model that takes into account an autonomous vehicle’s entire lifecycle, from deployment through to the end customer’s experience. The third is regulatory approvals and compliance, which play an important role from the very beginning, in the proof-of-concept phase, and throughout ongoing operations. And lastly, there must be a profitable, sustainable economic model largely focused on the financial impact of autonomous assets. Figure 5 provides some examples of revenue generating opportunities associated with the ecosystems described in this article.

The adoption of autonomous technologies will depend on many participants and technical elements working together to create a common operating system with universally accepted technical standards and algorithms. Autonomy must work so vehicles, infrastructure, and systems are not in conflict—for safety’s sake, perhaps the most important aspect of how we approach autonomy. In other words, success will depend on a broad aggregation of people and organizations working together to solve problems and integrate their solutions and services in a way that benefits everyone.

Figure 5: Examples of Revenue Generating Opportunities for an Autonomous Vehicle Ecosystem

The decision about whether to actually participate in the autonomous vehicle space will not be easy, as it could significantly change a company’s capital structure and operating costs. In particular, long-range supply chain decisions like network design, building a factory or distribution center, modernizing a fleet, building or buying assets, labor costs, and technology upgrades will be deeply affected.

It is important to consider the following questions before taking the very consequential step of introducing autonomous vehicles and related processes into your business:

Once the decision to play in the autonomy space has been made, companies will be faced with many important choices in three major domains: technology, regulation, and operating model. One decision area within technology will be customer facing, including how they will price the product or service they will offer, what kind of experience they want the customer to have, and what features they will include in the product or service. Another will include issues like privacy and security (how much of either to provide, and to whom) and whether to utilize open or closed architecture. There will be many decisions regarding the vehicle technology itself, such as which guidance, navigational, and safety-related technologies to use.

In regard to compliance with national, state, and local regulations, operators will in many cases have little or no choice. But there will still be decisions to make about how to comply, whether or not to operate in areas with different regulations, and what kind of credentials and safety management systems and record keeping to adopt.

What kind of operating model to deploy will be another key decision. Will your autonomous vehicles operate on the street, in the air, over long distances, or just a few city blocks? How physically close to the end consumer will they get? A different, still critical perspective on operating models involves what can be called the “test and learn philosophy.” Companies will have to determine the most appropriate and effective ways to test and prove not only the feasibility of their concepts but also the safety, integrity, and reliability of their solutions. Before they can begin testing, they must decide on testing methods and procedures; how many tests will be required to prove that an autonomous vehicle is safe and reliable; where and when to test; whether anything less than 100% success is acceptable; what kind of further testing will be carried out when results are unacceptable; and what role humans will have in testing and evaluating the technology, among other considerations.

Adopting an autonomous system to replace a current practice or to perform new tasks will be difficult. To ensure that an autonomous system will work effectively, companies should take the following steps:

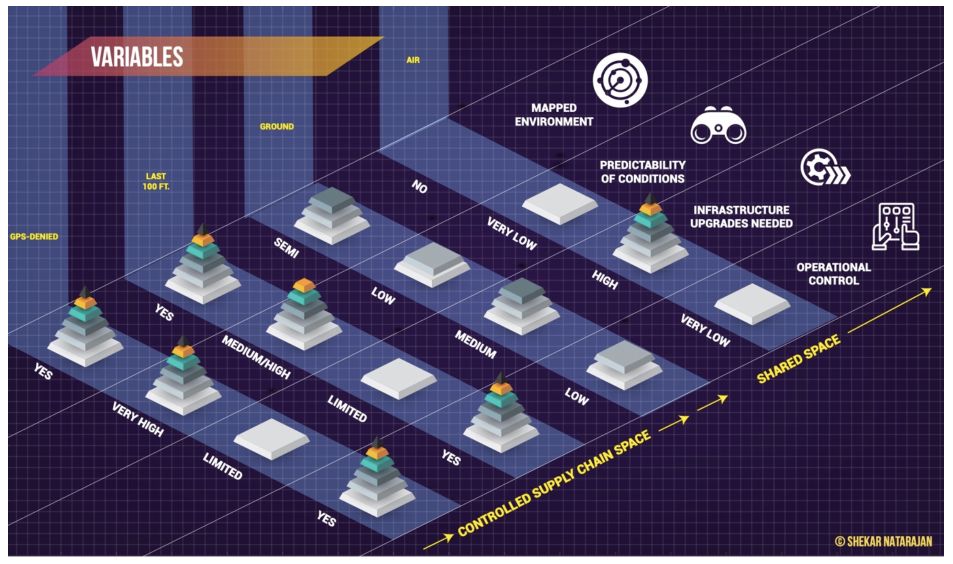

Figure 6: Variables in Project Complexity

Figure 7 provides a framework for assessing the complexity of use cases for air and ground autonomous vehicles, progressing from low to high complexity. The categories of complexity are as follows. Operation type: Autonomous vehicles that only interface with an operator are simpler to manage and have fewer risks and liabilities than those that interact with customers. Topology type: It is easier to manage and operate an autonomous vehicle in a rural area than in a congested urban setting. Control type: When autonomous vehicles operate within visual line of sight (VLOS) they are easier and safer to control than when they operate beyond the line of sight (BVLOS). Payload: Drones or other autonomous vehicles that operate without a payload are easier to operate than those that carry a payload. Additionally, carrying a payload reduces the drone’s range and exposes the user to liability issues such as material loss and injury to humans. Functional use: The more functions and technologies are integrated into the vehicle, the more difficult it is to manage. Movement type: It is easier to manage an autonomous vehicle traveling a point-to-point route than one that travels multiple routes that may not be contiguous. Asset in motion: It is simpler to design and manage a traffic-control system for one vehicle than a multi-asset model requiring integration of ground and air systems.

Figure 7: Framework for Assessing the Complexity of Use Cases for Air and Ground Autonomous Vehicles

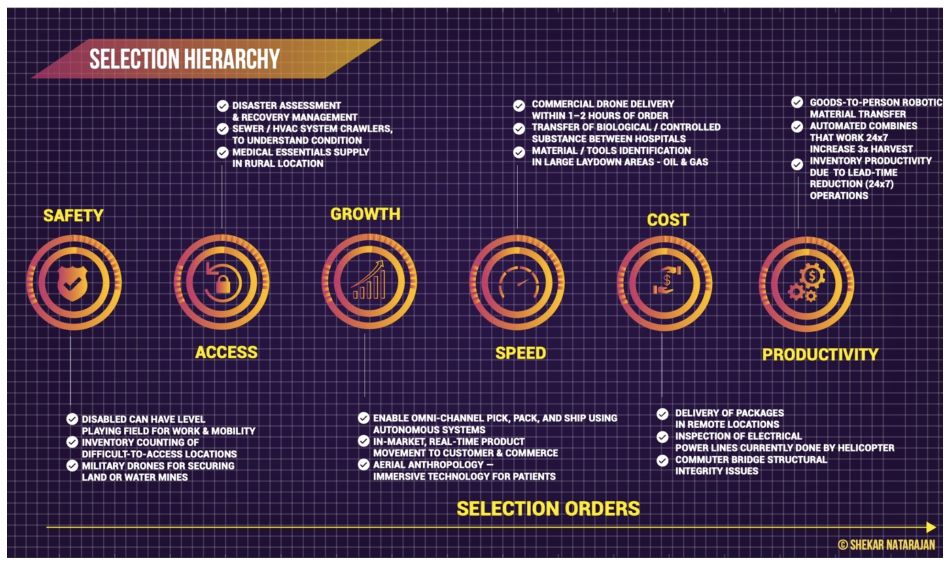

Another way to prioritize would be based on how important it is to the company and/or its customers to solve the problem an autonomy project would address. For example, a company’s most important reason for pursuing an autonomous vehicle project might be to improve safety. Improvements in speed, productivity, and cost could be lower priorities. Figure 8 shows six areas where companies could use autonomous vehicle implementations to make improvements, along with some possible examples.

Figure 8: Six areas where companies could use autonomous vehicle implementations to make improvements

6. Have a plan for managing data collection, storage, and analysis. Autonomous vehicles continually produce huge amounts of data. This creates three challenges for operators. The first is how to collect that information and use it, without latency, to make real-time decisions and take real-time or near real-time actions. The second is how to determine which signals are important to keep, and which can be discarded. The third is how to distribute the storage of so much data. There will be too much to keep in one location; from a risk management perspective, it would be unwise to do so anyway. But when forensic research becomes necessary—for example, to recreate an accident and identify its causes—it will be critical to know where all the data is located and how to access it.

As is the case with most revolutionary technologies, there will be barriers to adoption of autonomous systems. The biggest may be the difficulty of gaining acceptance. For example, for a long period (and perhaps always) autonomous systems will operate in conjunction with legacy systems; if they are to be accepted, autonomous vehicles such as drones, cars, and trucks will have to seamlessly and safely operate in a “mixed” environment, without negatively impacting the safety of existing operations. Moreover, the cybersecurity of autonomous systems will have to be assured.

In traditional transportation and distribution operations, humans have played the primary role in responding to off-nominal (abnormal) conditions or when contingencies (chance events) occur. Autonomous systems will have to prove that they can effectively manage any off-nominal conditions, contingency operations, and novel situations. It is critical, therefore, to ensure that the autonomous systems can safely and accurately operate in complex environments.

In light of those concerns, it’s not surprising that most company leaders have not considered whether and how to adopt autonomous vehicles. Nearly two-thirds (64 percent) of the executives who participated in a Techpro study, for example, said they had not thought about how their companies might apply autonomous technologies. Only 21 percent said they were just starting to craft a strategy, 13 percent were in the process of deciding where to apply autonomous technologies, and less than 1 percent said they were already active in this space [2].

Those who are holding back should not wait too long. One reason is that, generally speaking, with new technologies, the first mover often has a clear competitive advantage. In addition, there are other reasons that are specific to autonomous vehicles. Companies that get into autonomy early on could help to shape policies and legal frameworks under development by regulatory agencies. Consider that companies like Amazon and Google have differing views on whether the airspace for autonomous vehicles should be closed (and therefore tolls could be charged) or open to every operator. If others don’t make themselves heard, just a few companies will influence government policy. Another reason to move early: specific operating concepts must be certified as safe and be approved by the regulating agency before a test or pilot phase can proceed. Whenever a variable changes, moreover, companies must undergo the rigorous certification process all over again. Innovators should therefore move ahead as quickly as they can to get approval for testing.

We are just beginning to understand how autonomous vehicles will impact logistics and supply chain operations. For example, processing advances in sensors, machine learning, and artificial intelligence are already pushing computing farther out in a supply chain. In the future, autonomous vehicles could not only function as a mobility system, but they also could serve as both a local storage device for the relevant sensor data and as a “mesh network” for processing it—an example of “edge computing.” Such a data-rich information infrastructure will help enterprises to fluidly align and realign resources and workflows within redesigned networks and supply chain architectures.

In an autonomous future, business models and partner networks may look radically different than they do today. It’s important to give serious thought to these potential changes now. That’s because they throw many assumptions into question: the sustainability of existing companies, which future partners to bet on, and current business models, pricing approaches, and payment structures.

Traditional strategic boundaries will be upended, so that the successful businesses of the future will be those that can adapt to rapid changes in production, sourcing, and distribution. Foresight and a willingness to focus on the future will be needed if business leaders are to place the right strategic bets on the technologies that will position their companies for success five to 10 years from now.

Because supply chain organizations touch nearly every corporate function in some way, they are well positioned to lead the adoption of autonomous technologies. In addition to their usual areas of responsibility, they must be prepared to act as the connecting thread among a wide range of other internal functions, from information technology to human resources, and be able to help colleagues understand opportunities and use cases. The ability to play a role in change management and developing a cross-functional governance model will be essential, as will a commitment to supply chain innovation.

Adopting a game-changing, radically new technology is never easy. In the case of autonomous vehicles—whether on the ground, in the air, or plying the oceans—require supply chain innovators to move aggressively yet pragmatically. The key will be to invest in an autonomy project only after determining that it’s a strategic fit and will be a core activity of the organization.